Multi-family homes make for great investment opportunities. They have a lower cost per unit than standard single family homes, and they allow you to work on a larger scale, giving you an opportunity for greater profits. Following are five useful tips for boosting your net operating income on your multi-family investment.

Have All of Your Expenses Mapped Out

Make sure to account for all of your expenses. This includes things such as repairs, advertising, taxes, lost income due to vacancies, utilities, landlord insurance, mortgage, property management fees, bookkeeping costs, and other expenses. Always make sure that you leave some room over for emergency expenses that may come up. You need to make sure that you plan for all of your expenses when deciding on the cost of rent.

Know Your Laws

It’s crucial that you know all of the laws governing landlord-tenants relationships, particularly laws that pertain to owners of multi-family properties. Know your responsibilities and liabilities as well as any zoning laws.

Screen Tenants Properly

Having the right screening process is crucial. If you want to boost your net income, you need to have a steady cash flow. Tenants who cannot pay the rent or cannot be relied upon to pay it on time should not be rented to. Screen all candidates and check their credit scores and previous renting history. Make sure they are financially stable.

Another thing you may want to consider is updating your pet policy. Let’s face it: Pets will often end up costing you money. Dogs, cats, and birds can urinate on the floors and carpets, stink up the apartment, make messes, and stain the walls. There are plenty of tenants you can rent to who don’t own pets. Even if you do allow pets, you can screen for pets of a certain kind or size or require a pet deposit.

Remember to follow all fair housing laws when screening tenants.

Advertise Your Property

Setting up the right advertising campaigns will help ensure that you attract a steady flow of high-quality applicants and that you reduce your vacancies and tenant turnover time. Don’t rely on billboards or signs on the front lawn. Advertise in local classifieds. If you can’t afford to do so offline, do it on free internet posting sites.

Know When Renovating Is a Good Idea

Not all renovations and additions will prove to be profitable or worthwhile investments. You may want to install fancier countertops in the kitchen or a more stylish showerhead or faucet in the bathroom, but they won’t necessarily translate into higher rental rates and earnings. Always take into account your ROI when making new renovations. For example, renovations that allow you to add more room may translate into being able to charge higher rental rates.

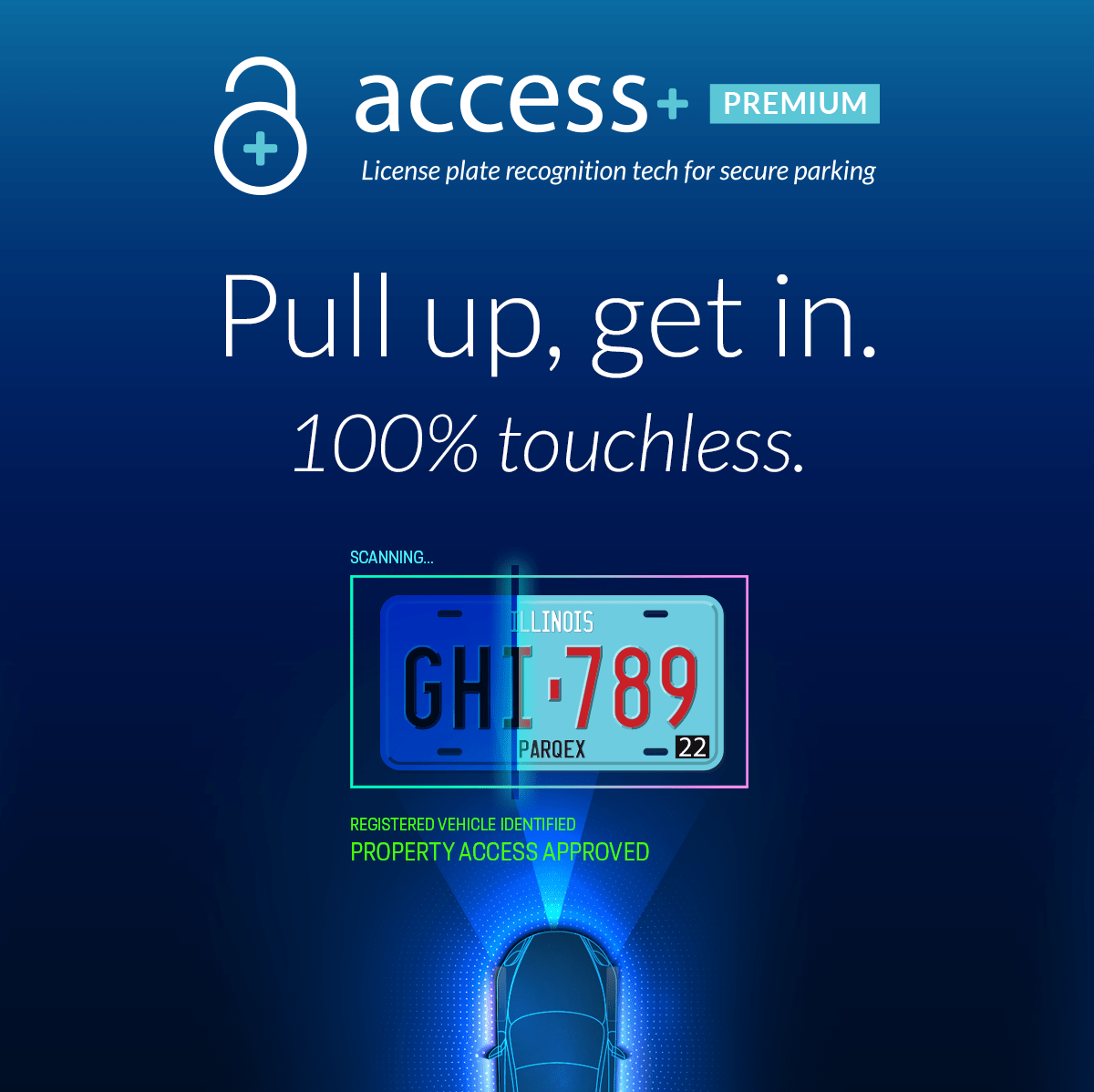

A good example of an investment that will pay off is offering a modern parking solution. Being able to advertise your property as one that provides parking will help attract tenants and allow you to charge more for rentals. Our technology even lets you make extra income by allowing tenants to book parking spots for guests or by renting spots to non-tenants when the parking spaces are not in use. It also has features such as a virtual garage door opener and an enforcer feature that makes sure the right vehicles are parked in the right spots. Go to this page to see the benefits of this technology and case studies of how it increased revenue by $34k or more.

Contact us today to learn more about ParqEx solutions and how we can help you earn more revenue from your multi-family property.